On the income side, Millennials are considered the most entrepreneurial generation of all, with its number of small businesses already outnumbering those of Boomers. (By age 30, 51 percent of White Millennials own homes versus 20 percent of Black Millennials.) Notably, homeownership shifts with ethnicity, with Latinx and Asian Millennials lagging, followed by Blacks.

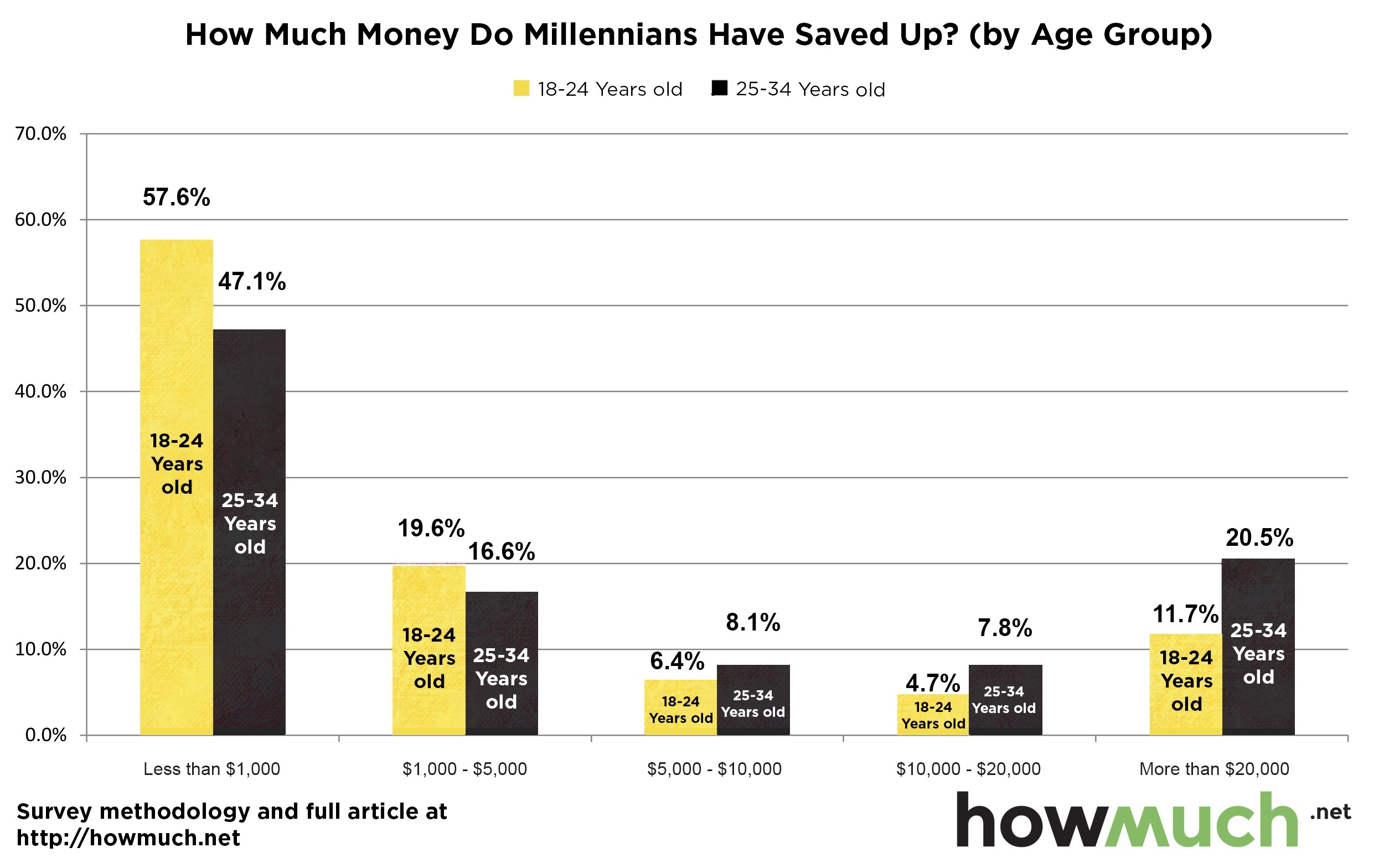

However, across the whole demographic, the number of those planning to rent “forever” is increasing: to 18 percent in 2021 versus 12 percent the year before. Some 60 percent of older Millennials (born between 19) have found their way to homeownership. Fifty-three percent of American Millennials have received financial assistance from a family member since turning 21, according to the 2018 Country Financial Security Index. They also are having a discernible impact on Millennials’ road to financial independence. Those numbers add up to more than just monthly payments. What’s more, the average Millennial also has about a $3,700 balance on their credit card. While the median monthly payment is $200, many are paying considerably more. Nearly almost 4 in 5 older Millennials are dealing with student loan debt, having typically borrowed about $22,000 each, according to a Harris Poll/CNBC Make It survey. As with everything Millennials do, however, these newest members of the Sandwich Generation are approaching this life stage in their own way, driven both by new points of view but also new challenges. Life in the Sandwich Generationīorn between 19, Millennials are zooming into this life stage at top speed, comprising 39 percent of the Sandwich Generation today versus 25 percent five years ago, with the pandemic intensifying their parents’ need for help.

Now as this demo turns 40, this radically resilient bunch who has grown up in the shadow of the Great Recession, taken on student debt levels their parents could never imagine, and navigated homeschool, caregiving and working during a pandemic is now facing what may be its biggest challenge yet. Today, they hold the title of the largest cohort in America, at an amazing 72.1 million strong. Millennials have ruled seemingly from day one, garnering fervent media attention - good and bad - at nearly every turn. However, the number of Millennials planning to rent “forever” is increasing: to 18 percent in 2021 versus 12 percent the year before.

60% of older Millennials (born between 19) have found their way to homeownership.53% have received financial assistance from a family member since turning 21. As a group, Millennials are weighed down by student loan and credit card debt, forcing them to delay home buying and other big life decisions.Millennials now make up 39% of the Sandwich Generation, up from 25% five years ago, with the pandemic intensifying how many have to help their parents.

0 kommentar(er)

0 kommentar(er)